Are you perplexed by what Wall Street analysts might term the recent “correction” in the collector car marketplace? Would you like to know how soon prices might swing back toward bull-market levels?

Well, and believe it or not, you might want to check the pricing fluctuations of housing in London, England, because the experts charged by Hagerty with tracking collector car values have discovered a definite link between real estate there and the collector car marketplace here.

We’ll come back to that in a bit. In the meantime, this story begins with my quest to discover how the number crunchers at Hagerty come up with their valuation guides for the sort of vehicles cherished by car enthusiasts.

So I trekked off to Traverse City, located on the fingernail of the little finger of Michigan’s mitten-shaped Lower Peninsula, where Hagerty has its headquarters. The company was founded in the mid-1980s as a mom-and-pop agency that specialized in insuring vintage wooden boats.

It turned out that many clients also owned classic automobiles and wanted them insured. So many, in fact, that Frank and Louise Hagerty called their son, McKeel, home from his studies at a seminary to help manage the work load.

Today, the company employs more than a thousand people, nearly two dozen of whom evaluate vehicle values. Magneto, a British magazine that considers such things, puts McKeel Hagerty among the three most influential people in the entire collector car world.

Just as Hagerty has evolved from an insurance company to insurance and valuation, and increasingly toward an automotive lifestyle enterprise that recently acquired the Greenwich Concours d’Elegance, so has the definition of collector car changed since the company was founded.

The Classic Car Club of America defines a classic car as those produced between 1915 and 1948 and distinguished by their design, engineering and workmanship. Many states issue “classic” license plates to vehicles at least 25 years old. Hagerty’s definition leans more toward all vehicles owned and driven occasionally by car enthusiasts, and thus includes not only CCCA classics but vehicles such as Ford Mustangs and the first-generation Subaru WRX STI and Honda CR-X.

Hagerty’s research says there are more than 30 million such enthusiast vehicles registered in the United States, 12.7 million of them pre-1981 models and 18 million produced since the 17-character vehicle identification number became standardized.

Obviously, as an insurance company, establishing accurate vehicle values is an important aspect of the business. But Hagerty takes the process another step, sharing that information through its Hagerty Price Guide, which is designed to help people make smarter buying and selling decisions, explained Brian Rabold, Hagerty vice president of valuation services.

It is now unavoidable truth that we are far removed from the post-Great Recession upswing we experienced from 2010 to 2015. Clearly, scores of sellers who set their reserves according to last year’s prices have now been duly informed.”

So how does Hagerty arrive at its valuations? It gathers information from its private insurance clients as they buy and sell their cars. It gets sales information from a network of collector car dealerships. It examines classified advertisements for collector cars. It collects sale prices at collector car auctions, live and online, while its staff goes to auctions and examines and evaluates vehicles on the dockets.

In 2018, Hagerty’s team did in-person inspections and valuations of more than 14,000 auction vehicles, nearly 60 percent of all cars sold at public collector-car auctions. It gathered data from more than 1.15 million classified advertisements and from 415,000 public and private vehicle sales, the company says.

The evaluators categorize vehicles into six groupings based on condition, from “parts car” to “beyond-perfect restorations.”

The team also breaks down vehicle ownership by demographics and can point out how Millennials are interested in cars older than themselves, especially those that are affordable, can be personally maintained and for which parts are available. Meanwhile, one reason for the recent increase in the prices of Volkswagen vans and early sport utilities is the access to camping and other lifestyle activities they provide to Gen X.

Oh, and those “modern collectibles,” their appeal spans multiple generations.

But despite all of this data, even the experts at Hagerty misjudged the recent Monterey Car Week. It expected sales at the six Monterey auctions to reach $378 million, a figure that would represent about a 2 percent increase over 2018 figures. But the auctions posted only $264.5 million in sales, a nearly 30 percent decrease compared with the previous year.

In a post-Monterey essay for the Hagerty Insider, Hagerty vice president of valuation services Brian Rabold wrote, “The short take is that the market has indeed softened. It just hasn’t changed as drastically as you might think.

“It is now unavoidable truth that we are far removed from the post-Great Recession upswing we experienced from 2010 to 2015. Clearly, scores of sellers who set their reserves according to last year’s prices have now been duly informed.”

And, he added, “For those of us who buy cars primarily for love rather than profit, this could be viewed as a good thing.”

His essay ended with, “In a restrained market, people are still buying cars. They just aren’t buying the nonsense.”

In a conversation in Traverse City, Hagerty senior data analyst John Wiley added that what people were lacking in Monterey wasn’t money, but time. With six auctions taking place in just three days, and with so many other events to attend on the car-week calendar, and with overall economic and even political uncertainties, well, even car collectors sometimes know when to hold ‘em.

But how might we know when the market is ready to halt its slide?

Wiley wrote in the post-Monterey analysis in Hagerty Insider that there is a strong correlation between the S&P Global Luxury Index and collector car prices: “The index anticipates the period of elevated auction sales following the 2009 recession, then the plateau from 2014 to 2016. Even the 2017-2018 bounce at Monterey registered similarly to the index,” he wrote, adding, “Note that the index is trending up, overall.”

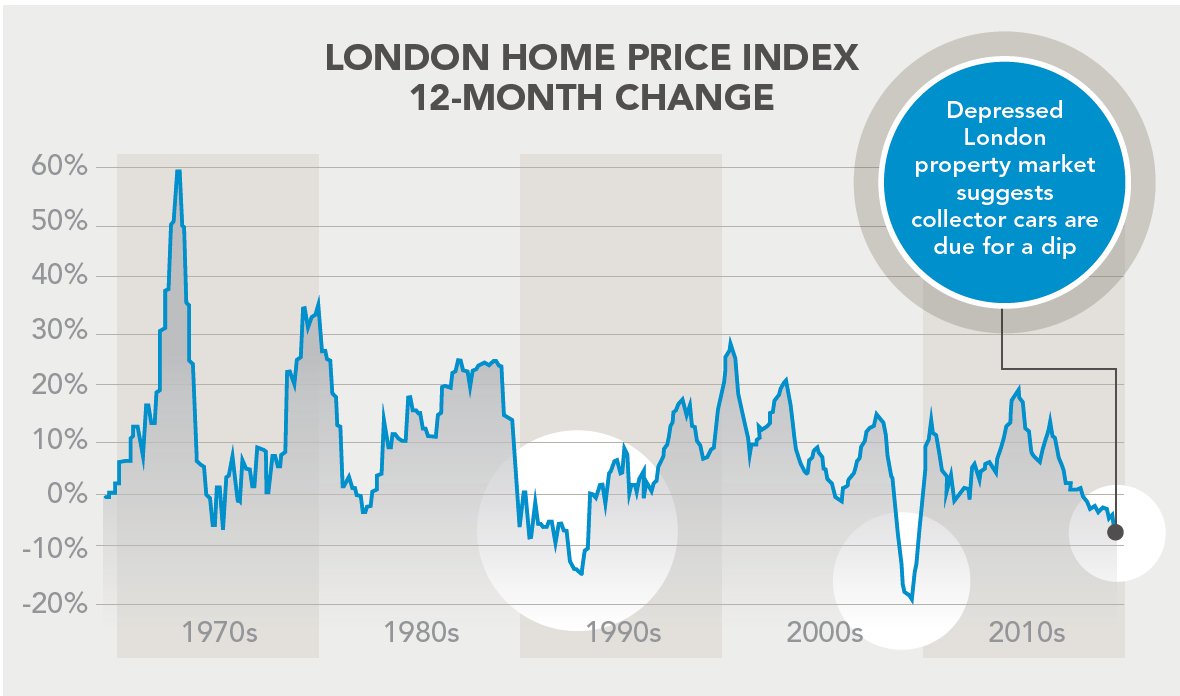

And believe it or not, Wiley suggests you pay attention to the price of housing in London as an even better bellwether of collector car values. After extensive research, he told me in Traverse City, Hagerty researchers discovered the surprising connection between the price of a London home and the collector car market.

Why? “Because they face the same global economic factors,” he said.

“London home prices have a long history of leading collector car market values,” Wiley wrote in the Insider. “Crashes in the collector car market appear to coincide with periods when the 12-month change in London home prices has dipped below zero.

“The period of 1989-1993 is notable. Absent is the 2001 drop. So, as we contemplate Monterey sales, we might want to check in on folks looking for a pad in Kensington Mews. The 12-month change has been below zero since January 2018.”

One factor that skews such analysis, he added, is the Brexit controversy in England and how quickly it might be resolved. Otherwise, and dating back several decades, the parallel between the ups and downs in London housing and in collector car prices is amazingly, even startlingly, close.

Who’d have thunk it?

Hagerty’s analysts, that’s who.

The data does not support individual car prices declining. It cites only gross sals volume. More likely, the number of cars sold declined and prices stayed the same. And trying to tie collector car prices to Kondon homes is a stretch not to mention unscientific. Cmon you can do better than this sketchy “journalism”