Russo and Steele celebrates two decades in the auction business this year, with its 20th annual Arizona auction taking place January 15-10. What a wild ride it has been for Drew Alcazar, along with his wife and business partner, Josephine.

“(The Auction) is always a daunting task,” Drew said. “It’s like planning the world’s biggest party and hoping somebody comes.”

Alcazar, once a theater arts major at the University of Colorado, started his first restoration shop at age 21. One of his early crowning achievements, in the 1980s, was the 100-point restoration of a 1969 Cobra Jet Mach I. The car went on to set a world record when it was sold to LA Times publisher Otis Chandler. Drew has always played with cars.

Ch-Ch-Ch-Changes

First on the docket, we asked about the shifting paradigms of the collector car world in the past 20 years since he and Josephine began Russo and Steele.

“The broad diversity of the cars,” Alcazar said. “Thirty-five years ago, you had Mustang guys, you had Camaro guys, you had Ferrari guys … Mopar guys. It was very segmented. The collectors today are much more diverse. In today’s collection you might see an Aston Martin DBS all the way to a 1958 Corvette – and kind of everything in between.”

Obviously, the prices so many cars have fetched at auction was notable.

“The value of these cars has appreciated many times over,” he added. The value of a collector car, seen from an investment medium, has proven to be a really wild investment as long as you were in it for the long-term rather than a short-term.”

Drew noted that the crowded marketplace has changed things significantly and muddied the waters.

“In the collector car auction space, (there) is almost an oversaturation of that market. There are too many options and they are too often,” he said. “It’s heartbreaking to say, I am one of the few that has a leg to stand on with that opinion, because I have been in the game for 20 years which is radically different to some of the ‘Johnny Come Latelys.’ Open up any of the trade publications, go online anywhere you want to. There is a collector car auction going on somewhere every single weekend.

“I mean, Dana Mecum didn’t start his global conquest until eight years ago, maybe? Mecum has had the biggest effect on that market saturation because of the fact that his TV contract requires him to do an auction on a monthly basis and content-wise, he needs to do in excess of 5-to-6 hundred cars each auction. The marketplace just doesn’t have the ability to both provide inventory and, most importantly, have that inventory absorbed.”

Brick and Mortar v the Internet

Certainly the 2,000-pound gorilla in the room is the internet and online auctions. Alcazar weighed in on that as well: “One of the biggest things that has changed in the 35 years when I opened up my own shop to today, is, of course, the internet. Well, we’ve been on this dirty, bumpy back road before, when eBay in the ’90s was going to put us all out of business, blah blah blah; I’ve heard all this before.

“Bring A Trailer shifted the paradigm with their pre-screening process. It ensures higher quality because the people that are pre-screening know what they’re looking at. But it also made sure that the sellers putting reserve on the car based upon market data points that Bring A Trailer had. Bring A Trailer did that first before any of the other of the internet stuff, even arguably eBay, which never got that sophisticated with it.

“That’s the question I’m having about the biggest game changer, is the proliferation of this internet sort of situation,” Alcazar noted. “Now I get it, it’s not new, because you can find a car on eBay, but I still look at people and say, ‘Listen, if you want me to send a picture of the car… oh trust me.’ I can get the biggest piece of (garbage) barn find that you can name. I will take pictures of it and make it look like it’s ready for the concours lawn, and you’re buying a car from some guy that you don’t even know?

“But when you start talking about real genuine collector cars, they aren’t just some cheap kind of fun novelty. A genuinely collectible car. I don’t know, talk about a Jaguar E-Type, let’s talk about a GT350 Shelby, let’s talk about a numbers-matching Hemi Cuda with documentation. You need something that’s genuinely collectible, and you’re going to buy that off of a computer screen? That’s just the stupidest thing that anybody could do.

“So, is that dynamic changing? Yes. Do you buy a car on the internet? Like I said, to me, it’s like buying a box of Cracker Jacks. You’re either going to get a good toy or you’re going to feel like you got gypped. It’s a dice roll, 50/50. Truthfully, ask all of the collector car auction houses. Whether it’s RM, Gooding, Russo, Barrett, Mecum, you name it. Online auction sales are still a single-digit percentage point of their transactions.”

Domestic tranquility

Alcazar, never shy about sharing opinions, weighed in on the changing – or for that matter, not changing – provincial and generational shifts in the hobby.

“The domestic U.S. market has always driven collector cars. Always,” he said. “You had blips in the ’80s when the Japanese got involved and went bananas, everybody was prophesizing that, oh, god, the Chinese with all this money, they should be buying 250 (model) Ferraris.

“The Chinese market is never going to impact collector cars. Why? Because they don’t understand them. You can’t appreciate something if you don’t understand it. Chinese understand Rolls-Royce, they understand Ferrari, they understand Aston Martin, because they can do an associated name sort of recognition to it. But they still haven’t got to the point to where there’s an appreciation for the older vintage cars. The Chinese market would still much rather park a Rolls-Royce in their driveway that has three less miles on it and is 10 minutes newer than their neighbors’. He’s the cool kid.”

European car collectors typically approach the hobby totally differently than American collectors, Alcazar added.

“Truthfully, Europeans don’t collect cars like Americans collect cars,” he said. “Americans collect cars like we drink red wine. We pop the top off, we chug-a-lug it down, say thank you, give me another. Europeans crack open a bottle of wine, let it breathe for a couple hours, or drink it slowly and savor it. Americans being the big lighter kind of disposable, instant-gratification creatures that we are, we really drive the collector car market. Europeans never have. Why? Because they hold their cars too damn long.

“That’s started to change a little bit in the last 10 years, but prior to 10 years ago, the same family owned that DB5 Aston Martin for 50 years. If you talked to them about selling it, it was like trying to sell one of their children. They’d look at you like you were insane. So, the domestic market has always been the engine that’s driven the train of the collector car market.”

Talkin’ bout my generation

Drew is bullish on the generations coming up, just not immediately.

“The (younger) market in the United States of America is just beginning, because it’s ingrained into your skull, whether it’s remakes of ‘Starsky & Hutch’ or it’s one of the major manufacturers. They’re making Bullitt Mustangs and Challengers and Camaro ZL1s for a reason, because all of those things are still at the forefront of your mind.

“Here’s the missing ingredient: Gen Xers and Millennials don’t have any money. Baby Boomers came into their discretionary dollars 10 to 20 years earlier than the current generations. Why? The Baby Boomer generation went to work. Gen Xers and millennials didn’t. They’re still living in their folks’ basement when they’re damn near 40 years old. As a result, they don’t have the discretionary income that the preceding generation had. It will happen. I believe there’s just a delayed reaction.”

Everybody Wang Chung Tonight

The worst car era, ever, did produce some real gems, if anything from that era survived…

“Further, you have a very, very dark time in automotive technology production design and execution, and that dark time was dark for everybody, it’s called the ’80s,” Alcazar said. “It was a wonderful time (otherwise), but all of the cars sucked. I don’t care what it was. It didn’t matter whether it was a Ferrari, or a Ford Mustang, or a Yugo. They were all pieces of crap.

“They were plastic, they were anemic, the performance was terrible. We had V8s that were making 104 horsepower with a hair dryer stuck on the side of it, called the turbo, or so they thought. Everything in the interior was plastic. Twenty-five years later, that stuff is disintegrating and falling off in your hand when you try and turn the knob.

“Now, you look at those cars that happened during that time, and the thing that’s interesting is the cars that did survive that era, I believe, will become very collectible and highly coveted.”

Mustang Memories

What makes a car collectible? Drew says no matter how good or bad the car, they all hold special memories for some people and pique our sentimentality.

“What happens when you’re the kid that says, you know what, that was the car, it was a Mustang GT, it was the little funky painted louvers on the tail lights, and it had the spoiler on the back, and it was my 5.0,” Alcazar pointed out. “I was like Vanilla Ice in high school. That was my cool-ass car, and it had the little vanilla aroma tree hanging from the rear-view mirror. I want one of those again. Why, because that’s what collector cars are. Collector cars are recapturing those moments.

“So what happens when one does show up? And it’s a hundred percent stock? You’re going to say, “What does it cost? 30 grand? 40 grand? 50 grand? OK, I’ll take it. I want it. I’ll buy it.”

Market adjustment

Much has been published in the last half decade about a “market adjustment.” The news all seemed to be doom and gloom after the disappointing 2019 auction results in Monterey. Drew disagrees with much of the market speculation and explains why:

“If you look at the auction houses since 2015 and you extrapolate all of their cumulative data, you will see that sell-through rates were plummeting. Sell-through rates were going down not because auction houses were necessarily selling less cars, although that was the result. But truthfully, it’s because the sellers continued to have higher expectations than the market wanted to grant them.

“So, something had to change because arguably since 2015 to today, and let’s say that’s a 5-year period, there’s been a lot of what I call a ‘Mexican standoff.’ It was like one of those spaghetti westerns from Sergio Leoni with Clint Eastwood and everybody was standing around staring at each other. You can see their eyes, they’re staring at each other, staring at each other. No one wanted to draw because the sellers wanted to maintain, ‘Hey I’m going to get prices from 2015,’ and the buyers would stand there looking back saying, ‘No, we’re not going to pay that no more.’

“So something had to cause that to change to some degree. And so truthfully, I think some of what we want to call now maybe the Monterey effect from 2019, is that is, I’m hoping, that it will be that catalyst that finally gets some of these seller/collector-type guys to go, look, if you’ve got this car, OK, let’s pick something that’s a super-duper stable car. A 250 GT Lusso Ferrari. The Lusso in ’15 was worth about 2.1ish, right in there. Now, they’re worth about 1.8. so you went from 2.1 to 1.8, OK? That’s the market.

“Part of what happened I believe was some degree of correction. And I know we’ve talked a little bit about Monterey before. It’s not so much that, first of all, some data point that says, ‘oh my God, the collector car market corrected.’ What was the Monterey percentage? Something ludicrous. A Twenty-two percent (downturn year over year) or some crazy thing like that.

“A couple of cars were a result of that anomaly. The Shelby Cobra, the GT350, the Hemi Cuda fully documented, all original numbers-matching LS6 Chevelle convertible, ‘58 fuel-injected Corvette, Jaguar E-type, wasn’t instantaneously worth 22 percent less after Monterey. It just wasn’t.

“But the thing that’s interesting for me I think, and the biggest parts of the positive byproduct is that since the hype of the market, which you could argue one side or the other, there’s been a gradual correction that’s happened since 2015 across the board, I don’t care what you want to look at, 250 Ferraris to Volkswagen. But what was happening is that many of the sellers were bringing inventory that still had this 2015 expectation.

“What is that percentage or correction? OK, do the math, it is what it is. But if that car’s sitting around and all it’s doing is holding up a car cover, and you hadn’t seen the damn thing for a year because the last time you took it out to the cars and coffee was a year ago, and you hadn’t even seen the thing, and you keep taking the insurance payments and the carburetors are going rotten, and now you got to rebuild all those damn things, and the battery’s going flat, and the tires are cracking.

“At some point in time you just go, ‘You know what, sell the car.’ Why don’t you get something that you’re more excited about, something that you’re having more fun with, rather than clinging to this… make peace with the fact that the market is what the market is, and start thinking about it from a different direction and start saying, Hey, did my Lusso go from 2.1 to 1.8? Yeah. Does it suck? I don’t care how much money you have, to lose arguably 300 grand on a car, OK. Taking a quarter of a million lick ain’t for the faint of heart, I don’t care how much money you have. If somebody comes and steals a quarter million dollars of your lunch money, you’re mad, right?”

Super ’86 Supra

Not known for selling Japanese cars at the Russo and Steele auction, Drew tells a sentimental story about an ’86 Toyota Celica Supra:

“My first serious girlfriend, when I was 16, had a Toyota Supra, and I thought that was the coolest car at the time. The wedge with the fenders on it, that bi-spoiler on the back, and it had that big Supra logo on the back of it. It had a six cylinder, which was amazing at the time. But even better yet, it had the stereo with the equalizer in it right in the console.

“I’ve been looking for one of those cars for 25 years,” he said. “Every time you find one, it’s crazy weirdo gold color with the red velour interior and an automatic transmission, and you go, oh god, I’m just not buying one of those.

“Then, three months ago, I found this crazy nut job that had kept this car. It’s a P model, the very last year, ’86. So, it’s the performance version, not deluxe version, with a five speed. Black, with a gray interior. I paid $25,000 and I put another five grand into (it).

“Again, I’m that quintessential collector that just says, look, I want to recapture something that resonates with me, and I’m going to do that through my collector cars, no matter what they may be.

“Like I said, whether it’s a 5.0 Mustang, whether it’s a Toyota Celica Supra, whether it’s a Viper, whether it’s a ZR1. On down the line, that interest, that passion, I just don’t see dying. I don’t see going away.”

quite honest interview on the current state of the industry,and after the dirty politics dealt to them i wish them luck in the new location for Scottsdale 2020

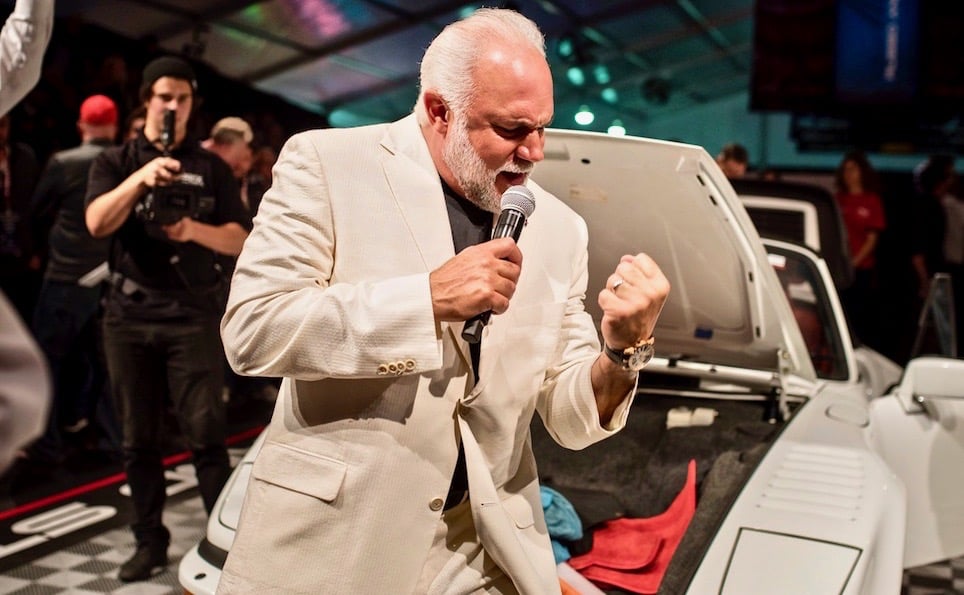

You can always count on Drew for a highly informative, colorful interview. The man knows cars inside and out. I’ve been to every Russo and Steele Scottsdale auction since year 1. Love the auction in the round production, with Drew as the head showman. Drew and Josephine work so hard to deliver an incredible experience for all attendees.

Looks like Drew’s PR machine is hard at work. Must cost a lot of $ to offset his image as a crooked used car salesman.

Jon, we will be featuring several auctioneers in the next few days. Love him or hate him, Drew and Russo are major factors in the specialty car world. Thanks for reading!

Drew hit the nail on the head,love it hate it car prices fluctuate Robert and I have purchased several cars from russos auction even the 39 Cadillac . If you love cars you work on them understand how they work and use them .they all require maintenance just like your home .Stop counting the dollars and enjoy the hobby and the friendships along the way. We’re here for a good time not a long time .ps your Canadian companions.

I agree with the majority of things Drew said, however, I strongly believe he is wrong about one thing as it relates to online versus physical auctions.

Drew says that an online auction auction requires the bidder to "trust" the accuracy of the seller, which is dangerous given the seller’s motivation is to maximize the hammer price. Drew says that a physical auction is safer for the bidder because they are able to see the vehicle in person, rather than rely on photos (which Drew correctly points out can be shot to make a piece of you-know-what look like a museum piece).

Drew is only correct to a point. An online auction such as Bring-a-Trailer gives potential buyers FAR MORE INFORMATION about a vehicle than is available on most lots at a physical auction such as R&S, Mecum, or BJ.

This is because you don’t get to drive the car at a physical auction, but can only hear it run. You can’t do an underneath chassis inspection. In most cases you can’t talk to the owner, or get a good vehicle history. This means there is still a very big risk at a physical auction that causes one of two things to happen: 1) the bidder is too conservative because of the unknown and misses out on a great car, or 2) an unsuspecting bidder pays too much for a car with hidden flaws.

Of course, the first response to this is say… the same problems are there for an online auction, but even more so because you can’t see the vehicle in person.

NOT TRUE. Most online auctions (take Bring-a-Trailer as an example) run for a week or so. With Bring-a-Trailer potential bidders can be put in touch with the seller to go over everything. More importantly, the bidder can easily (and inexpensively) have the car driven and inspected so that they know exactly what they are getting. With Bring-a-Trailer potential bidders also get the advantage of having the vehicles vetted by a community of experts on the car who often are able to point out if a nut or a bolt is not original. The detail of the vetting at Bring-a-Trailer needs to be seen to be believed.

Bottom line, I make a firm prediction that the online auction model will grow leaps and bounds over the physical auction model over the next five years. Although this is only my opinion (based on the points made above), back in the late 90’s and early 2000’s my career was focused on analyzing (and predicting) the ways that the Internet would (and wouldn’t) supplant traditional brick-and-morter in the auto industry. I should also mention that back then I correctly predicted that EBAY’s online model was not going to be the success that many predicted because it made both vetting and direct contact between bidder and seller difficult. Therefore, my thoughts are not based on being a big fan of Internet auto sales, but instead based on the changes to the respective business models that will occur based on consumer demand.

I would welcome to hear the thoughts of anyone with a different opinion.

Thanks for this interesting, insightful interview on the state of industry with one of the most knowledgeable characters in the collector car business. A couple to insights that I thought

were spot : the Chinese market … “ You can’t appreciate something if you don’t understand it”…

In my opinion something as commonly collectible for decades as a ’57 Chevy or a hot rod

would be lost on that market. They have not had the experience of going to a drive-in on a

date or the kind of memories American youth had with cars of their era. As often mentioned

we collect what we desired as kids or what our dad may have owned. China does not have that automotive history so the closest they can come is collecting tractors.

Regarding the sell-through rate Drew is on target too. As the auctions profligate they naturally

lose some of their appeal just as the Hollywood Awards shows have. At least they have a

season for their shows. In congratulatory Variety and Hollywood Reporter ads I stated that

"LA has three seasons: Summer, Holidays and Awards". Collector cars auctions are now year

round, not to mention the daily on line end of the business. Naturally the sell-through can be expected to fall off as Drew stated the market cannot absorb the inventory.

I look forward to your interviews with the other titans of the collector car industry while

I attend this years “Showtime”.

James Groth