After falling in nine of the previous 12 months, the Hagerty Market Rating increased in April, although only by a mere 0.03 points.

“The collector car market held firm this past month as momentum continues to shift towards the entry and mid-level segments,” McKeel Hagerty, chief executive of the family-owned collector car insurance and value-tracking company, said in a news release.

He added: “As buyers become choosier, the best examples of performance and luxury cars from the 1980s and later continue to see the most activity.”

The Hagerty news release noted that auction activity enjoyed its largest increase of the year in the past month, driven by more cars being sold, primarily cars produced in and since the 1980s. It noted that the Mercedes-Benz 560SL sales were up 15 percent, 2001-08 SL sales grew 11 percent, and 2005-14 Ford Mustang sales at auction increased by a whopping 41 percent.

However, private sales activity declined for the second month in a row, down some 2 percent, and with a decreasing number of cars selling for more than their insured values.

For example, Hagerty’s news release pointed out that 1968-70 Dodge Coronets are off 20 percent in the past year, 1961-63 Ford Thunderbirds are down 33 percent over the same period and even 1984-98 Porsche 911s are down 7 percent.

The insurer also noted that, “Requests for insured value increases among broad market vehicles fell for the eighth consecutive month and saw their largest month-over-month drop in over three years.”

Examples: Value increase requests for 1965-73 Ford Mustangs have declined 15 percent in the past year and those for 1964-68 Porsche 911s are down 44 percent in the same period.

Further, requests for insured value increases for high-end vehicles experienced the largest month-to-month drop this year. Value increase requests for 1964-67 Sunbeam Tigers down 53 percent and for Ferrari 246 Dinos down 32 percent over the past 12 months.

However, the 30th edition of the Hagerty Price Guide was released and shows an increase on value of condition 3 cars in the sub-$25,000 market.

Another positive sign is that expert sentiment in the past month had its biggest increase so far this year, though still is less than its January figure.

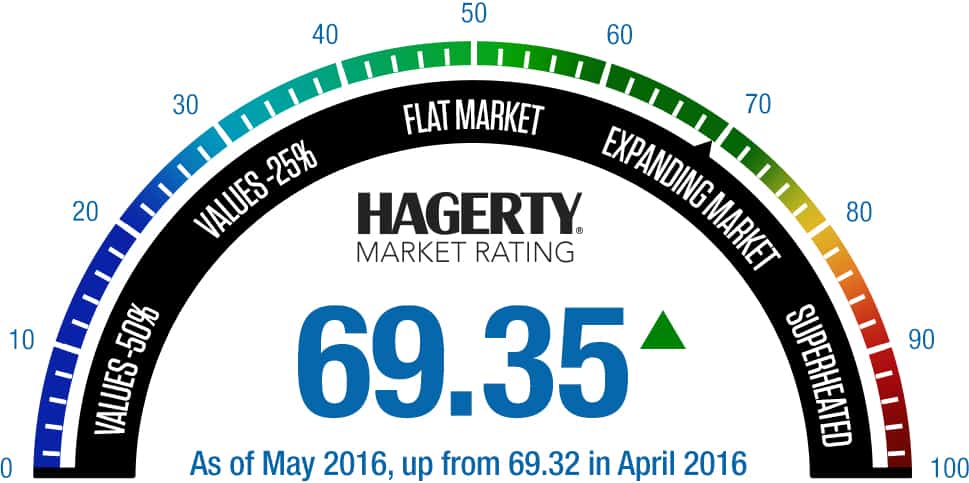

The Hagerty Market Rating is based on a weighted algorithm that considers 15 proprietary data points in eight categories, including public auction and private sales, values of insured cars, price-guide values, Hagerty’s own index system and input from industry experts.

The rating, reported at the middle of each month, is based on a 100-point scale and is presented in the form of a tachometer-style gauge, complete with a “superheated” red zone, a sort of warning that we’re approaching a possible burst of the bubble. Ideally, the market cruises along comfortably in the 60- to 80-point “expanding” zone.

Although first released in January 2015, Hagerty applied its formulas to the classic car marketplace dating back to January 2007. The rating then was in the low 60s. During the economic recession, it slumped to the high 40s and has been on an upward trend since late 2010.